September 2021

On September 26, 2021, Germans will go to the polls for the 20th time since 1949. As such, one issue will be in the spotlight: the steadily declining level of old-age provision for an increasingly aging population. To mark the occasion, we are devoting this issue as a piece to provide insight into the election programs of the major parties and an outlook on what could occur.

Content

Insight

UNION

CDU/CSU want the statutory pension to remain central alongside occupational and private provision. The introduction of a new funded pension plan with a pension fund is to be examined (“generation pension”).

According to the election program, a monthly state contribution would be made to the fund. The first payments would then be made from the birth of a child. A monthly contribution of 100 euros is planned until the child’s 18th birthday. An obligation to provide for old age is to be introduced for all self-employed persons, with freedom to choose the type of provision (state or private).

A new concept has been announced to make company pension schemes more attractive for low-income earners A new start is to be made with private pension provision: A “standard pension product” is to be developed, which all employees will automatically take out – unless expressed otherwise. The product is to be characterized by no acquisition costs and low administrative costs.

SPD

The pension level is to be stabilized at least at 48 percent; an increase in the retirement age is not considered. The self-employed, civil servants, freelancers and politicians should also be covered by the statutory pension insurance. Riester is to be replaced by a “Swedish model,” according to which contributors must pay at least 2.5 percent of their income into a state fund or a fund of their own choice, in addition to their contributions to the statutory pension. Subsidies would only be available for lower and middle income groups. Auch Selbstständige, Beamte, freie Berufe und Politiker sollen der gesetzlichen Rentenversicherung angehören.

Green

The pension level should remain at least at 48 percent. In order to achieve this, the Greens are counting on more women working and a “genuine immigration law. At the same time, older workers and those in precarious employment situations are to receive more support (the “basic pension” is to become a “guaranteed pension”). As a supplement, there should be a funded pension – as a publicly administered “citizens’ fund” into which everyone who does not object contributes. This fund can also be used for company pension plans.

FDP

A “basic pension” should combat old-age poverty and prevent people from applying to social welfare by increasing their income. A statutory “share pension” is to be introduced based on the Swedish model. The main part of the contributions from employees and employers should continue to flow into the pay-as-you-go pension insurance, but a smaller amount of, for example, two percent of gross income should flow into a share savings model. The FDP also advocates a more flexible retirement age as soon as the basic income support level is reached. Company pension schemes are to be made simpler, for example by offering more opportunities to invest money there.

Left

The pension level is to be raised again to 53 percent and the entry age is to be lowered to 65 years. A “solidarity-based employment insurance” should also cover the self-employed, freelancers, civil servants and politicians. A minimum monthly pension of 1,200 euros is to be guaranteed for all those who have a lower retirement income. The private Riester pension is to be abolished.

AfD

People should be able to choose when they retire – those who work longer will receive a correspondingly higher pension. Old-age poverty is to be curbed by not counting 25 percent of the pension toward basic security in old age. Families are to be reimbursed 20,000 euros in pension insurance contributions for each child from tax revenues, without any reduction in pension entitlements. Politicians and civil servants are to pay into the statutory pension scheme in the future.

Summary

As always, the election programs resemble a ‘wishing well’. The wish to safeguard statutory pension at a pension level of at least 48% is continued, in particular with the inclusion of further groups of gainfully employed persons (Attention: many think that this safeguarding level refers to their individual last salary. It is correct that the pension level indicates the ratio of the standard pension to the average earnings of all insured persons. One receives the standard pension if one has always earned the current average wage for 45 years and paid pension contributions on that amount. This is almost impossible for many employees). The election pledge of “Die Linke” (the left), which calls for both an increase in the pension level and a reduction in the retirement age, seems almost utopian – how will this be financed remains a financial policy mystery that will hopefully never have to be solved. In addition, many parties envision mandatory contributions to a state-organized fund (“Swedish model”). Private and occupational pensions are dealt with only in passing. Whoever wins the election, one thing is certain: pensions will remain an irritating topic even after the election. The new government will hardly be able to avoid a realignment of the statutory pension system – it remains to be seen what this will ultimately look like, but it is likely that unpleasant truths will come to light.

Outlook

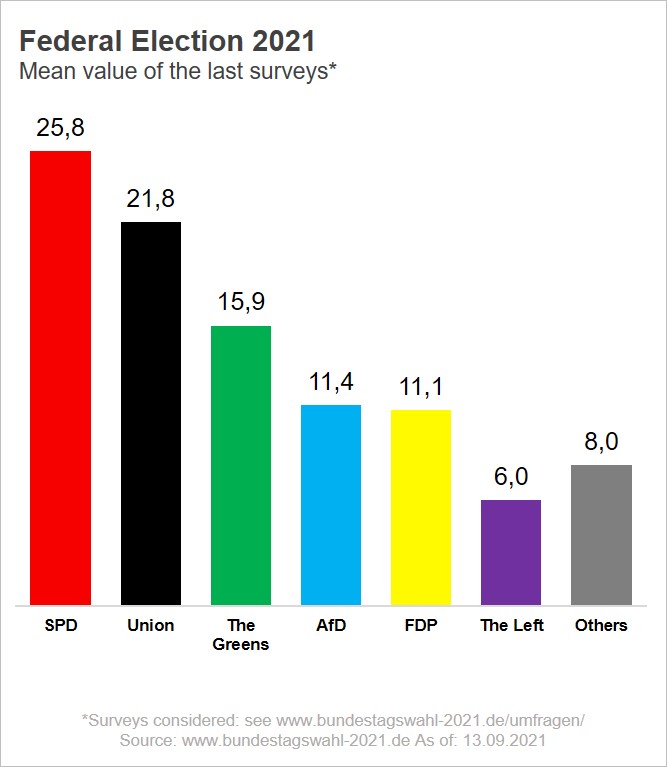

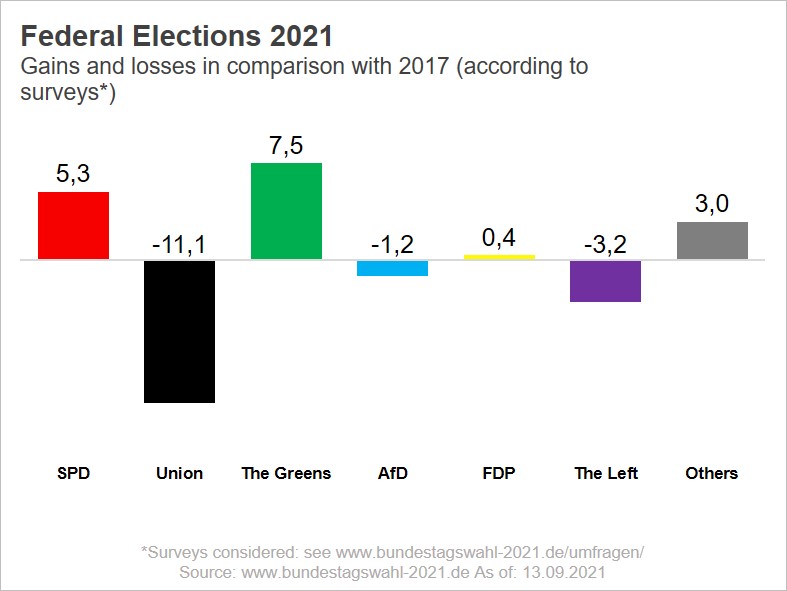

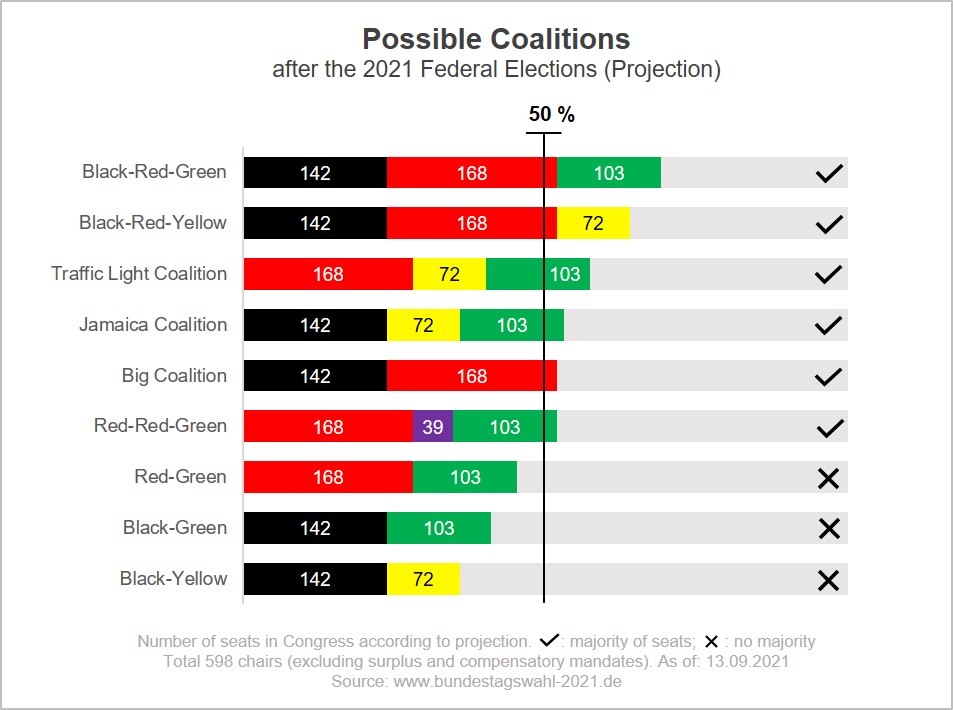

And what could be the outcome of the election? Enclosed are three current charts on the election outcome, vote gains and losses, and possible coalitions. Since the vote distributions are more volatile than ever, it remains exciting to see what result we will have after the votes are counted on Sept. 27, 2021. In any case, the prospect of a 3-party coalition lowers hopes that Germans will finally tackle many unresolved issues – including pensions. This makes a strong company pension scheme more important than ever.

Source: Bundestagswahl 2021 (website in German)

Last update: 09.09.2021 8:38am