June 2021

The topics covered in our current newsletter are: “Lowering of the actuarial interest rate”, “Allianz compares pension systems worldwide: Germany only in 26th place”, “Company pension scheme remains the most important benefit for employees” and “Transparency and sustainability”.

Content

- Reduction of the Actuarial Interest Rate

- Allianz Compares Pension Systems Worldwide: Germany Only Ranked 26th

- Company Pension Schemes Remain the Most Important Benefit for Employees

- Transparency and Sustainability

- Legitimate Use of the Part-time Factor in Part-time Work

Reduction of the Actuarial Interest Rate

At the end of April, the Federal Ministry of Finance announced the reduction of the maximum actuarial interest rate as of January 1, 2022, from the current 0.9% to 0.25%.

A change in the maximum actuarial interest rate has a delayed effect on company pension schemes and will not affect contracts that were already concluded by December 31, 2021. For new contracts starting on January 1, 2022, the guaranteed benefits of the insurance contract will be reduced accordingly. The overall performance of the contract will not necessarily be affected. This is a result of the guaranteed interest rate and the insurer’s individual profit sharing. If the overall return on the actuarial reserves remains constant, the total performance of the contract also remains steady despite a reduction of the actuarial interest rate. The Profion product team has been keeping an eye on this development for some years now. We are intensively looking into alternative benefit solutions, in case company pensions in their traditional form should one day no longer be well received by employees. However, that time has not yet come – as shown by the table and graph in the following articles.

Allianz Compares Pension Systems Worldwide: Germany Only Ranked 26th

Germany became world export champion for the fourth time in a row in 2019. Although Germany ranks highly in the comparison of international economies, its pension system can only be described as mediocre. According to an international comparison of pension systems published a few months ago, Germany only ranks 26 out of 70 countries. This means that additional old-age insurance is an important issue for German employees and will remain so for the time being.

| COUNTRY | RANK | TOTAL VALUE | INITIAL CONDITIONS (VALUE) | SUSTAINABILITY (VALUE) | APPROPRIATENESS (VALUE) |

|---|---|---|---|---|---|

| Sweden | 1 | 2,9 | 3,4 | 3,0 | 2,6 |

| Belgium | 2 | 2,9 | 4,3 | 2,9 | 2,3 |

| Denmark | 3 | 3,0 | 3,3 | 3,2 | 2,5 |

| New Zealand | 4 | 3,0 | 3,5 | 3,8 | 1,9 |

| USA | 5 | 3,0 | 3,1 | 3,3 | 2,8 |

| Australia | 6 | 3,1 | 3,0 | 3,3 | 3,0 |

| Netherlands | 7 | 3,1 | 4,0 | 3,9 | 2,0 |

| Norway | 8 | 3,2 | 3,3 | 3,9 | 2,4 |

| Bulgaria | 9 | 3,2 | 3,8 | 2,7 | 3,3 |

| Canada | 10 | 3,2 | 3,4 | 3,8 | 2,6 |

| … | … | ||||

| Germany | 26 | 3,6 | 4,8 | 3,5 | 3,0 |

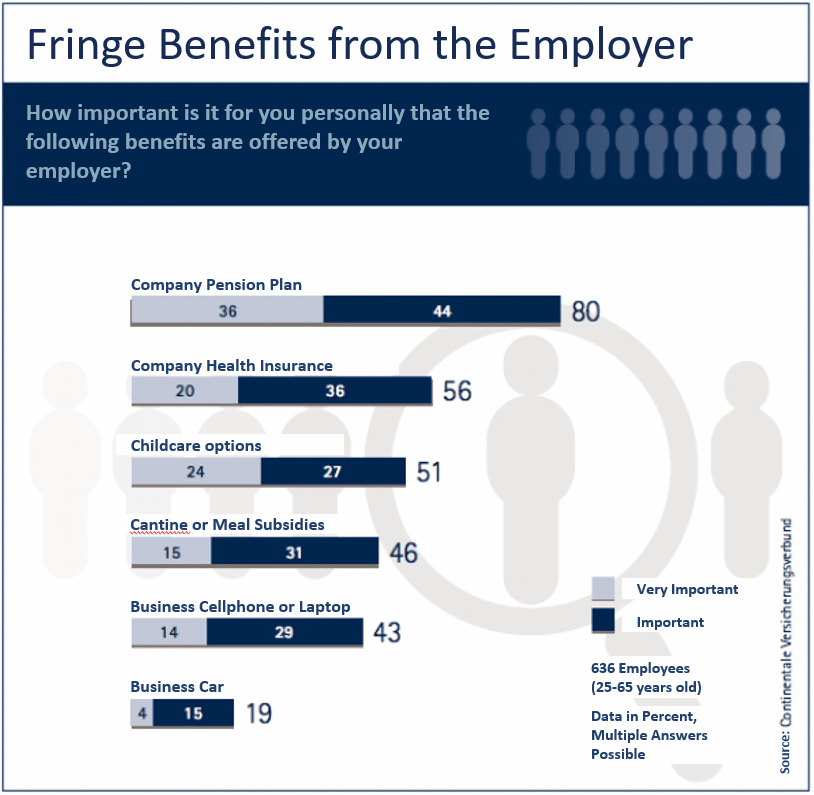

Company Pension Schemes Remain the Most Important Benefit for Employees

If companies want to retain employees, they can certainly score the most points by offering for company pension schemes. This was the result of a survey carried out on behalf of the Continentale Insurance Association. To the questions: “How important is it for you, personally, that an employer offers the following benefits?”, 80% answered that additional benefits for company pension schemes were “very important” or “important” to them.

Transparency and Sustainability

The EU Transparency Regulation (Regulation (EU) 2019/2088 on Sustainability-Related Disclosure Requirements in the Financial Services Sector) came into effect on March 10, 2021. The aims of the Regulation are to create a uniform EU-wide disclosure obligation at company and product level in regard to sustainability and to support the sustainability goals of the United Nations (UN). As a financial advisor and In order to remain as transparent as possible for our clients, Profion has updated its website based on the requirements of the new Regulation. This now contains, amongst other things, information on our strategy for the inclusion of sustainability risks and consideration of negative sustainability impacts. The topic of sustainability has always been of great importance to us as a company and employer: A sustainable old-age pension is our original business purpose. For its implementation, we decided on a non-profit organization – the EPF (Euro-BetriebsPensionsFonds e.V), an independent, fully congruent reinsured group support fund. And finally, as an employer, we make our contribution to a sustainable economy as much as possible – we achieve this through an almost paperless office and regionally produced organic drinks in glass bottles. This is our humble contribution to a better future.

Legitimate Use of the Part-time Factor in Part-time Work

In its judgement of March 23, 2021 (BAG, judgement of March 23, 2021, AZ: 3 AZR 24/20), the Federal Labor Court (BAG) confirmed that part-time work may affect the calculation of the company pension and that the periods of employment of part-time employees may only be recognized as proportional times. In the present case, the plaintiff, who always worked part-time, sought to have her 40-year part-time employment converted into the full-time equivalent of 34.4 years of employment with her employer, in order to achieve a higher retirement pension. According to the employer’s pension commitment, the amount of the company pension for part-time employees is determined by applying a part-time factor. The BAG considers this procedure to be accurate, since the plaintiff receives a company pension that is in the correct proportion to the amount of the company pension of a full-time employee. A violation of § 4 (1) Part-Time and Temporary Employment Act (TzBfG) should therefore be rejected. This approach is in line with Profion’s long-standing administrative practices.